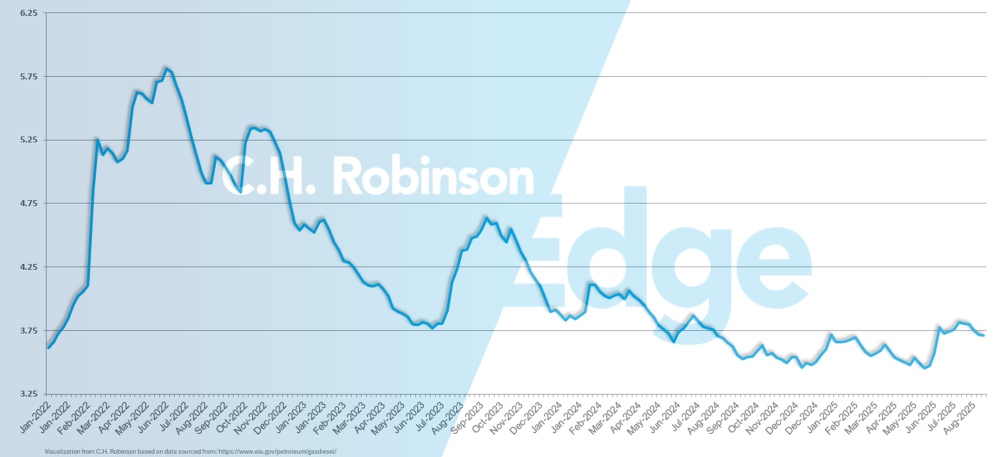

U.S. diesel prices rise y/y, ending 29-month decline streak

The national U.S. average diesel price per gallon of $3.74 in August was down from $3.78 in July. Despite this four-cent decrease month over month, the average price is now higher than the August 2024 year over year (y/y) comparison of $3.70. This y/y increase officially ends the 29-month streak of y/y decreases in fuel.

While diesel fuel prices are on the rise y/y, they remain relatively low compared to recent years. This has provided shippers with both direct and indirect benefits. Directly, lower fuel costs reduce freight spend through fuel surcharge calculations. Indirectly, they also ease pressure on carriers. In today’s soft freight market, where carriers have fewer load options, many are willing to deadhead farther to secure freight.

While fuel is mostly a pass-through expense, deadhead mileage in a soft market is often absorbed by the carrier. When fuel prices are low, those extra miles are less burdensome, allowing carriers to linger in the market longer. This dynamic has contributed to the slower rate of carrier attrition seen in the truckload capacity forecast.

If fuel prices were to rise meaningfully, however, the pressure on carrier operating costs would intensify, likely accelerating carrier exits from the market. Shippers would then face a double impact: higher fuel surcharges and reduced carrier competition, which could speed up the timeline towards the tight phase in the market cycle.

For LTL carriers, the impact is amplified by their network design, where frequent stops and short-haul pickups consume more fuel per shipment. This means higher operating costs across many smaller shipments, which can have an exponential impact on a hub-and-spoke model.

Beyond trucking, fuel cost increases can influence other freight modes as well. Intermodal providers face higher drayage expenses on either end of the rail move. Air cargo is also exposed, as jet fuel is closely correlated with diesel prices, leading to rapid fuel surcharge adjustments that can significantly raise costs on international and expedited shipments.

Even ocean carriers, though often powered by marine fuel oil, tend to adjust bunker surcharges in line with global energy price movements, meaning diesel increases can indirectly feed into higher container shipping costs. In short, when diesel climbs, it doesn’t just raise trucking costs, it reshapes modal competitiveness across the supply chain.

National U.S. average diesel price per gallon

Download slides

Download slides