Tariffs reshape consumer spending and retail supply chains

Consumer spending outlook may require different inventory strategies

After a modest uptick in July, several indices showed consumer sentiment slightly down in August. Consumers perceive a substantial risk for increased inflation in the near future. Tariffs are contributing to much of the economic worry, and several leading consumer goods companies have announced they’re being forced to raise prices on popular items.

After a surge of pre-emptive purchasing in July, ahead of higher U.S. tariffs imposed in August, a slowdown is likely ahead as well-stocked consumers forego their normal purchase cycles. Shoppers in lower income brackets were already pulling back on their spending. Middle- to upper-income bracket consumers have been trading down in terms of where they shop, the brands they buy, and quantities purchased.

As retailers and retail suppliers may need to move smaller amounts of product, precise inventory placement will be critical.

Item-level visibility, including centralized purchase-order management, helps retailers and suppliers avoid over-ordering where inventory isn’t needed, enables existing inventory to be redistributed, and allows for more precise ordering when more inventory is needed. Retailers may also be able to reduce transportation cost through optimized shuttle service between distribution nodes and “milk runs” servicing locations along the same route.

Shipping outlook for importers

Ocean peak season for retail goods normally starts in July and runs through October. This year, due to U.S. tariffs, it appears to have peaked in July. For the Port of Los Angeles, July set an all-time record. Anticipating lower demand going forward, ocean carriers are implementing blank sailings—temporarily canceling scheduled vessel departures—to maintain vessel utilization rates.

This means retailers and retail suppliers with continued import needs face fewer departure options and potential schedule disruptions as remaining vessels may skip destination ports. Ordering windows may need to be moved up in anticipation of longer lead times, but importers can take advantage of lower Asia-to-U.S. ocean shipping rates. Europe-to-U.S. importers can also expect service cutbacks. See our Ocean Freight report for more information and guidance.

When retailers are ready to move holiday inventory into position for early promotions, U.S. trucking capacity is expected to be plentiful and rates favorable. See our Truckload Shipping report and Less than Truckload Shipping report for forecasts and recommended strategies.

Low-value shipments now subject to tariffs

The de minimis tariff exemption for low-value imports to the United States ended August 29, 2025—a date moved up from 2027 as a result of an executive order. Shipments under $800, representing up to 4 million packages daily, have consequently lost their duty-free status. This is a significant change for global ecommerce, affecting retailers of all sizes but especially small to medium businesses that now also need to manage customs paperwork.

Duties must be collected from the shipper or recipient by the postal carrier and remitted to U.S. customs, either based on a flat rate per package or as a percentage according to the specific tariff rate levied on goods from each specific country.

The flat rate consists of three tiers:

- $80 if the tariff rate is 16% or less

- $160 between 16% and 25%

- $200 above 25%

Flat rates will end after a six-month transition period, at which point all packages will be subject to the percentage-based tariff.

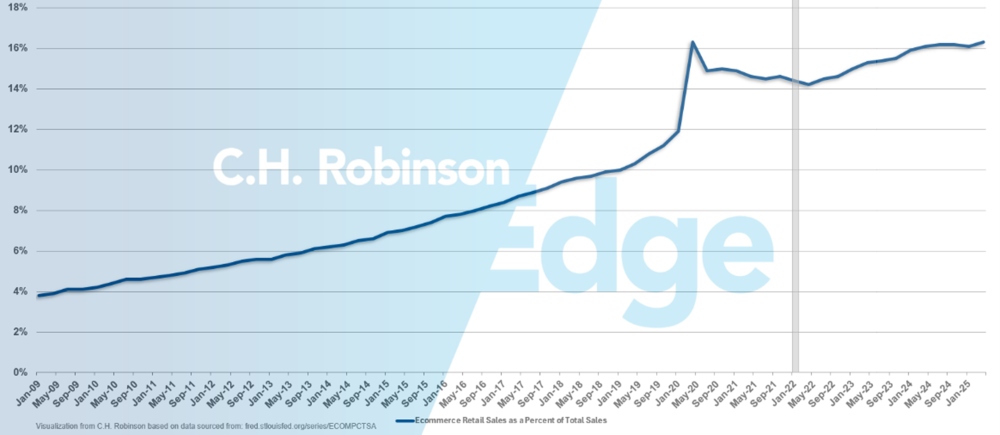

The end of de minimis comes against the backdrop of continued growth in ecommerce, which reached a high of 16.3% of total retail sales in Q2 2025, matching the previous high during the pandemic spike of 2020.

Ecommerce retail sales as a percent of total sales

Some retailers will need to remake their distribution, fulfillment, and transportation processes as a result of the de minimis change. Some may need to reassess their supplier relationships. C.H. Robinson retail experts and small-business experts can assist.

Potential tariffs coming on furniture

Furniture is the latest sector to be reviewed for added U.S. tariffs. After an initial announcement in late August that the review would be completed in 50 days, the U.S. administration clarified that this is part of an investigation already under way on imported lumber and products that use imported lumber. As with the copper tariffs in July, these investigations can swiftly lead to new Section 232 duties.

The impact of new furniture tariffs would depend on the product categories included and whether the tariff would stack on top of other applicable tariffs. Tariffs are already in place for imports from top furniture-exporting countries. For example, products from Vietnam face a 20% tariff and from China 30%. Adding to the complexity, furniture is also subject to a 50% tariff on any steel or aluminum components.

Visit our Trade & Tariff Insights page for the latest news, insights, and resources from our customs experts and to sign up for alerts.

U.S. appeals court rules on legality of tariffs

On August 29, 2025, a federal appeals court ruled that the U.S. administration didn’t have the authority to impose tariffs by declaring a national emergency, upholding a lower court’s decision. The reciprocal tariffs in place on imports from most countries were established under the International Emergency Economic Powers Act (IEEPA), as were tariffs imposed on goods from China, Mexico, and Canada with the goal of reducing the flow of fentanyl.

For now, the ruling does not affect importers because enforcement is delayed until October 14, 2025, and an appeal to the U.S. Supreme Court is expected. If the Supreme Court rules similarly to the Court of Appeals, it’s uncertain what the reimbursement process might be.

In the meantime, these reciprocal tariff rates remain in place:

- For imports from countries with specific reciprocal tariff rates established: 15-41%

- The baseline tariff for goods from other countries: 10%

- On Chinese imports: 10% rate now extended until November 10, 2025

These fentanyl-related tariffs remain in place:

- On Chinese imports: 20%

- On Canadian imports: Increased to 35% as of August 1, 2025, except for goods that are USMCA certified

- On Mexico imports: As of July 31, it was announced that the 25% rate would stay in place for at least 90 days. USMCA-certified goods remain duty free.

Our U.S. Tariff Impact Analysis Tool helps customers see what type of tariffs have been assessed on their products and analyze the impact to their bottom line. Our self-serve ACE Import Intelligence tool gives companies visibility to their customs data regardless of whether the freight is moved by C.H. Robinson. Our Sourcing Analysis Tool helps customers understand the tariff and supply-chain impacts of sourcing their goods from alternative locations.

Download slides

Download slides