Global congestion eases slightly, transit times more predictable

On this page

Ocean freight markets are adjusting to trade policy dynamics and capacity changes. While operational conditions have improved in recent months, shippers should prepare for volatility through the remainder of 2025.

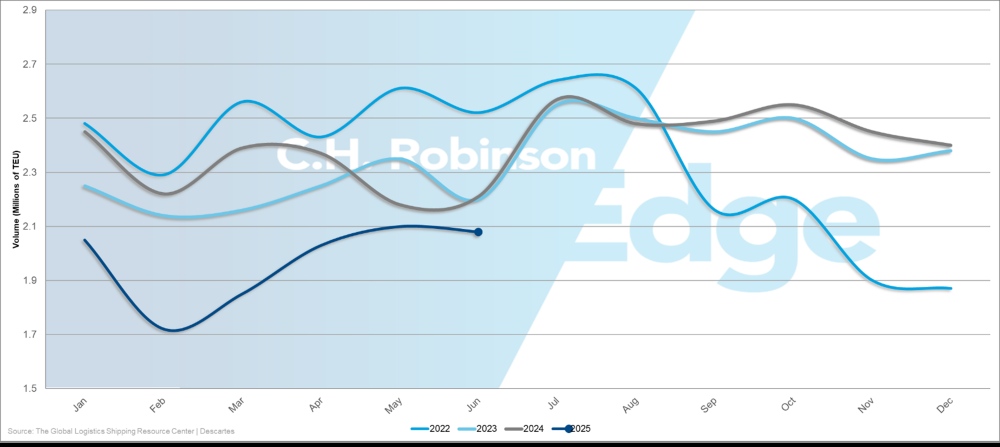

2022-2025 U.S. container import volume (TEU)

Global port congestion has eased, with the share of container capacity stuck outside ports improving from 10% in May to 8.4%. This shift means more ships are back in circulation, helping stabilize supply chains. While this represents meaningful progress, congestion continues to tie up substantial capacity at European and Latin American gateways. This is true for U.S. East Coast ports as well.

Transit times are becoming more predictable, but buffer time remains essential for time-sensitive shipments, especially when routing through congested regions.

What this means through Q4 2025:

- Bookings may open with little advance notice and fill up faster than usual

- Rate volatility expected as carriers adjust to shifting trade patterns

- Service reliability improving but regional variations persist

Asia

Early peak season disrupts traditional patterns

Both Trans-Pacific Eastbound (TPEB) and Asia-Europe lanes saw peak season earlier this year, with the usual September surge already past because of U.S. tariff changes effective in August. This shift in timing patterns means that September through December 2025 will likely see below-normal shipping volumes compared to historical trends.

The demand weakness is prompting ocean carriers to implement blank sailings—temporarily canceling scheduled vessel departures—to reduce available capacity and maintain vessel utilization rates. When carriers implement blank sailings, shippers face fewer departure options and potential schedule disruptions as remaining vessels may sail with altered port rotations or modified schedules.

This disrupted seasonal pattern creates both opportunities and challenges.

- Opportunities: Lower rates as carriers adjust to excess capacity

- Challenges: Reduced service frequency and potential schedule reliability issues

Companies may want to adjust logistics plans by moving some non-urgent shipments earlier to capture today's favorable rates, while also securing guaranteed space for time-sensitive cargo.

China tariff extension expected to have limited market impact

The 90-day extension of lower U.S. tariffs on Chinese goods through November 10, 2025, provides temporary cost certainty for U.S. importers sourcing from China but is unlikely to spur increased shipping. Many companies completed their inventory building by frontloading in June and July, leaving carriers with excess capacity for September demand that has not yet materialized.

The extension does, however, offer breathing room for U.S. importers to reassess their sourcing strategies and inventory positions without the immediate pressure of escalating tariff costs.

Asia–U.S.

TPEB spot rates continue their downward trajectory, though ocean carriers announced September 1 general rate increases (GRIs) in the hopes of more peak season demand. For carriers proceeding with the GRI, how long the rate will hold is uncertain. The underlying weakness in U.S. import demand suggests rate increases will not hold if cargo volumes remain below carrier expectations.

It’s more likely rates will remain under downward pressure as carriers compete for limited cargo. Companies can leverage this buyer's market, particularly for larger volume commitments. The current environment favors those who can provide volume certainty to carriers seeking to maintain vessel utilization.

U.S. importers with non-urgent cargo should consider spot market bookings to capture the most competitive pricing, while those requiring guaranteed space and schedules may want to secure contracted rates before market conditions potentially stabilize.

Asia–Europe

Asia-to-North Europe spot rates are falling at an accelerated pace while Mediterranean rates are declining more slowly, eliminating the traditional price differential between these destinations. This convergence means there’s no longer a significant advantage between North European and Mediterranean discharge ports based solely on rates. Greater flexibility in port selection then allows for more strategic supply-chain optimization beyond the cost of the ocean shipping itself.

Most carriers are likely to cancel proposed rate increases on Asia-Europe lanes, instead extending August pricing through the remainder of September. This decision reflects insufficient cargo demand to support higher rates, with carriers choosing market share over pushing through increases.

Considerations for Asia-Europe shippers:

- Rate opportunities: Excess capacity is contributing to a more favorable pricing environment.

- Port selection: Evaluate total landed costs including inland transportation, rather than focusing solely on ocean rates.

- Capacity planning: Prepare for potential blank sailings and service schedule changes.

- Service-level management: Balance cost savings with service reliability requirements.

Asia–South America

Despite rate reductions, securing space from Asia origins still requires two-week advance booking due to ongoing capacity constraints. Recent additional vessel deployment to East Coast South America (ECSA) has helped ease some of the pressure, but the trade lane remains tight relative to demand.

The extended booking lead times require more strategic planning compared to other trade lanes. Shippers should:

- Plan shipments with minimum two-week advance booking windows

- Consider inventory positioning strategies that account for longer lead times

- Evaluate alternative routing options through different South American ports

- Monitor capacity developments as carriers adjust service levels

North America

U.S. import volumes forecast to contract

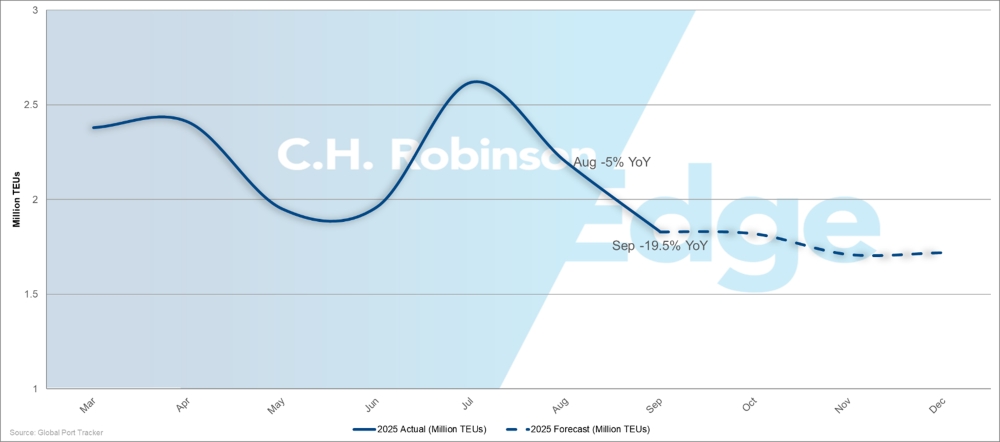

U.S. monthly import volumes 2025: Actual and forecast

U.S. import volumes are experiencing substantial decline after higher U.S. reciprocal tariffs took effect, with Global Port Tracker predicting that August will have ended with a 5% decrease and forecasting a dramatic 19.5% decline in September compared to 2024 levels. This represents a sharp reversal from the first half of 2025, which totaled 12.53 million 20-foot-equivalent units (TEUs)—up 3.6% year over year.

The projected second-half decline would reduce full-year import volumes to 24.1 million TEUs, down 5.6% from 25.5 million TEUs in 2024. This contraction demonstrates how quickly U.S. businesses and consumers are adjusting their buying patterns in response to higher tariff costs: delaying purchases, reducing order quantities, or sourcing differently to lower tariff exposure.

U.S. importers should plan inventory carefully for the remainder of 2025, balancing stock levels against the potential for lower rates but higher service uncertainty.

U.S. West Coast capacity increases clash with demand reality

U.S. West Coast (USWC) capacity is expected to rise 7% in September compared to August levels, but this additional space likely exceeds demand. Carrier capacity increases were planned based on traditional peak season expectations that are not materializing.

The combination of excess capacity and reduced demand creates multiple advantages for importers using West Coast ports:

- Spot market rates are expected to decline further as carriers compete for limited cargo.

- Shippers with higher volumes may be able to secure more competitive pricing.

- Extended agreements may be secured at favorable rate levels.

This buyer's market on the West Coast contrasts sharply with the capacity constraints on other lanes.

U.S. East Coast capacity contracts amid operational challenges

U.S. East Coast (USEC) capacity is expected to decline 6% in September, reducing space options for importers. With carriers cutting capacity due to weak demand and ongoing congestion, securing space allocation becomes more challenging and requires earlier booking commitments.

Companies should evaluate West Coast alternatives where inland transportation allows, as the capacity differential between coasts creates operational and pricing advantages for flexible shippers.

This evaluation should take into account:

- Ocean rate differentials between East and West Coast services

- Inland transportation costs from alternative discharge ports

- Transit time differences and inventory carrying-cost implications

- Service reliability and schedule consistency factors

U.S.–Asia

Trans-Pacific westbound lanes experience capacity constraints

U.S. exporters face tightening space availability to Asian destinations as carriers reduce capacity through blank sailings and smaller vessel deployments to match weakened demand. While some carriers maintain regular sailing schedules, others are cutting capacity, creating fewer booking options for U.S. companies shipping to Asia.

Major Asia ports like Singapore, Hong Kong, and Shanghai are experiencing persistent delays that create a ripple effect throughout supply chains. When vessels arrive late at these ports, they miss their scheduled connections to feeder ships or inland transportation networks.

In other words, cargo doesn't just face delays at sea or during port processing. It also arrives late for rail connections, truck pickups, and warehouse appointments that are critical for final delivery to customers. The cascading effect can extend total transit times by days or even weeks beyond the original vessel schedule, creating significant challenges for U.S. exporters with time-sensitive delivery commitments.

The combination of reduced capacity and schedule disruptions requires more careful planning and earlier booking to ensure space allocation. Traditional just-in-time delivery approaches are becoming increasingly risky as service reliability deteriorates and booking options diminish.

U.S.–Europe

Mediterranean Shipping Company's (MSC) elimination of the USEC service in mid-August removed a significant capacity option for U.S. exporters to European markets, creating an immediate supply-demand imbalance on this trade lane. This capacity reduction comes at a time when U.S. exporters are experiencing relatively strong demand for European destinations, a market dynamic that is driving up rates and reducing booking flexibility.

U.S. exporters should secure European bookings through alternative carriers well in advance and consider routing through other gateway ports to maintain schedule reliability. The reduced service frequency means significantly less flexibility for spot bookings.

U.S.–South Asia, Middle East, Africa

MSC to launch independent Africa service

Mediterranean Shipping Company (MSC) is launching a standalone service to Africa as of October 1, 2025, ending its current partnership with Maersk on this trade lane. This strategic shift represents a significant change in service structure that could affect capacity, routing, and pricing dynamics across the U.S.-Africa trade corridor.

MSC will operate independent schedules and potentially use different ports than the previous joint service, creating uncertainty about service levels and operational consistency during the transition period.

U.S. exporters shipping to Africa should review current booking patterns and delivery requirements, as MSC's new service may offer different transit times, port options, or sailing frequencies than previous arrangements.

Pakistan service cuts impact regional capacity

Several major carriers have stopped calling Pakistani ports due to ongoing security concerns, reducing overall service frequency to the Indian subcontinent. This means fewer ships are available to carry cargo to the region, creating competition for remaining space and higher rates.

Mediterranean Shipping Company (MSC) maintains the only direct service to Pakistan from the USEC, creating a bottleneck for U.S. exporters requiring direct routing.

Companies shipping to Pakistan should expect:

- Extended booking lead times: Minimum four to six weeks advance booking requirements

- Limited carrier alternatives: No backup options for direct service

- Premium pricing: Elevated rates driven by limited competition

Middle East shipping options remain limited

Only Mediterranean Shipping Company (MSC) and CMA CGM offer regular service to most Middle East destinations from U.S. ports. Orient Overseas Container Line (OOCL) has recently added limited coverage, while COSCO continues its suspension. This concentration limits U.S. exporters' options if their preferred carrier lacks space or prices are unfavorable.

The Red Sea crisis continues to divert cargo through congested transshipment hubs, adding strain across global networks. Carriers are expected to maintain upward pressure on rates through the remainder of 2025, citing operational challenges and limited competition. As a result, costs are likely to remain elevated while service reliability is disrupted.

Transit times are becoming less predictable due to congestion at key Middle East and South Asia transshipment ports including Jebel Ali (Dubai), Abu Dhabi, Mundra (India), and Colombo (Sri Lanka). Delays at these hubs can add several days to delivery times even when ships depart U.S. ports on schedule.

U.S. exporters should consider booking space at least four weeks in advance and build additional transit time into delivery commitments—typically an extra five to seven days beyond normal schedules—to account for transshipment delays.

U.S.–Oceania

Space becomes scarce during peak season

Major carriers are running out of capacity from both USEC and USWC ports through September as peak season drives strong demand into Australia and New Zealand. The capacity crunch spans both Trans-Pacific services and specialized Oceania-focused carriers, signaling that demand is outpacing supply across the network.

Companies should quickly evaluate alternative carrier options, as remaining capacity may fill rapidly or become more expensive as peak season demand continues.

September marks start of Brown Marmorated Stink Bug season

Brown Marmorated Stink Bug season began September 1. All cargo must comply with treatment and certification regulations based on vessel on-board dates, creating immediate compliance obligations for all U.S. exporters.

U.S. exporters should verify requirements before booking, as non-compliant cargo will face significant delays or potential return to origin.

Europe

Summer slump stretches into fall

Trans-Atlantic westbound freight activity slowed in August, when Europeans traditionally are on holiday and manufacturing and shipping activities decline. European companies tend to reduce production schedules and delay non-urgent shipments. The August slowdown in volume was more pronounced than usual, reflecting broader market uncertainties.

While September typically shows volume recovery from summer lows, this year's rebound remains uncertain due to new U.S. tariff measures implemented in August. U.S. importers may reduce or delay purchases of European products while assessing the cost implications of higher duties, potentially extending the traditionally brief summer slowdown well into the fall shipping season.

MSC exit squeezes Trans-Atlantic space

Mediterranean Shipping Company's (MSC) withdrawal of the North Europe-U.S. East Coast service removes significant capacity from the trade lane, reducing the number of sailing options for European shippers. This comes at a time when the market is already experiencing service challenges, creating a more constrained environment for Trans-Atlantic trade.

With fewer ships sailing this route and port delays keeping vessels in port longer, the remaining services will operate with tighter capacity. This means European exporters will have fewer backup options when their primary shipping arrangements are disrupted, requiring more strategic planning and earlier booking.

The combination of reduced service and ongoing demand uncertainty is creating a market dynamic where rates are likely to remain relatively stable. This rate stability, however, comes with trade-offs in flexibility and booking options. European shippers may find themselves paying stable rates but with reduced service choices and potentially longer booking lead times.

Europe-U.S. trade hits double trouble

Persistent congestion at both European and U.S. East Coast ports means that even when vessels depart Europe on schedule, delays at destination can extend overall transit times. This congestion affects the entire supply chain, creating uncertainty not just in departure schedules but also in arrival and cargo availability times. European exporters shipping to the U.S. market should prepare for transit time variability that extends beyond normal ocean voyage duration.

South Asia, Middle East, Africa (SAMA)

Turkey-Israel trade restrictions impact shipping operations

Turkish authorities have implemented apparent restrictions for Israel-affiliated vessels to call Turkish ports. This has prompted some carriers, including ZIM Integrated Shipping Services, to adjust their routing patterns and avoid Turkish ports as a precautionary measure.

These conditions will persist as geopolitical tensions continue. Shippers should prepare for:

- Sustained higher costs

- Longer routing and limited capacity

- Weak schedule reliability complicating delivery timelines

South America

East Coast South America

Santos, Paranaguá delays prompt port diversification

Santos, Paranaguá, Itapoá, and Itajaí are expected to continue experiencing delays and limited vessel calls. Shippers should expect extended dwell times and consider booking alternative ports when possible. Companies shipping to Asian destinations should avoid Santos or build an additional five to seven days into delivery schedules, as Asian services are experiencing the most severe delays.

Salvador, Imbituba, Suape, and Pecém offer better schedule reliability through September. CMA CGM's new Asian service at Imbituba provides an additional routing option starting this month.

Rio Grande may face weather-related vessel omissions in the months ahead. Vitória's twenty-foot-equivalent container shortage will persist, affecting smaller shipments. Fortaleza's fruit season requires advance booking for refrigerated containers to Europe.

Shippers should secure bookings at less congested ports early and build extra transit time into schedules when using Santos or Paranaguá.

Amazon River levels raise shipping concerns

Declining Amazon River water levels are forcing carriers to adjust vessel schedules and operations, with Rio Negro levels expected to trend downward through Q4 2025. These conditions are increasing costs via reduced cargo loading efficiency, higher pilotage fees, and greater fuel consumption.

To offset this, carriers are expected to apply seasonal surcharges. Shippers using the Port of Manaus in Brazil should plan accordingly. Coastal terminals, however, are likely to provide more stable pricing for cost-sensitive cargo during the low-water period.

Broader routing to strengthen Caribbean and regional networks

Caribbean transshipment networks are gradually improving, with Kingston, Jamaica, expected to resolve operational bottlenecks by Q1 2026. Congestion has been causing vessel delays and cargo-handling inefficiencies at the region's primary transshipment hub.

Better schedule reliability will support growing regional cargo flows through established hub-and-spoke networks, where cargo from South America is consolidated in Jamaica before distribution to smaller Caribbean destinations and onward connections to North America.

Ocean carriers are expected to keep about 85% of vessels on their usual routes, while testing alternative services through Colombia, Mexico, Peru, and Canada to better balance their networks. These adjustments are designed to keep direct port rates competitive as carriers adapt to shifting cargo flows.

Broader routing options will give shippers greater leverage and service selection, while reducing reliance on single-corridor performance and strengthening overall supply chain resilience.

West Coast South America

Chilean ports experience service interruptions

Weather conditions have been impacting West Coast South America (WCSA) operations, particularly in Chile, where carriers have implemented blank sailings and cut-and-run scenarios—emergency departures without completing full port rotations. These disruptions reduce sailing frequency and create unpredictable schedules for Chilean exporters through September.

Callao congestion intensified during commodity season

The Port of Callao, Peru, was briefly closed in August, leading to increasing congestion at the terminal. Also, a shortage of containers will continue during FLEXI season, when oil and commodity exports absorb much of the available equipment. Shippers using Callao should anticipate longer dwell times and plan bookings three to four weeks ahead to secure container availability.

Colombia, Cartagena offers an alternative to Buenaventura

Construction projects inside and outside Colombia's Port of Buenaventura continue to affect cargo handling. This infrastructure work is creating considerable congestion that is expected to impact vessel schedules and cargo-processing times through Q4 2025.

Cartagena terminal has recently improved operational efficiency and is proving more reliable than Buenaventura for cargo destined to the United States, Brazil, and Europe. The port's enhanced performance provides Colombian exporters with better schedule reliability and reduced congestion delays.

Colombian shippers should prioritize Cartagena over Buenaventura for time-sensitive cargo and evaluate inland transportation costs against potential port delays. Companies with flexibility should also consider routing through Cartagena.

South America-Asia

Brazilian agricultural exporters are expected to continue facing reduced demand as U.S.-China trade policies increasingly favor U.S. suppliers. Chinese commitments to increase agricultural purchases from U.S. sources may sustain pressure on Brazilian cotton and soybean exports. Expect cargo imbalances on Brazil-Asia lanes to become more entrenched as this policy-driven redirection takes hold.

Export rates to Asia are expected to remain competitive as carriers compete for reduced cargo volumes. Booking windows will likely maintain the current two-week flexibility, with carriers actively adjusting capacity to match evolving demand patterns.

Exporters can enjoy rate advantages on non-urgent shipments while diversifying their markets beyond traditional Asian buyers. Agricultural shippers in particular may benefit from spot booking availability during off-peak periods while securing advance commitments for harvest season volumes.

South America-U.S.

The 50% U.S. tariffs on Brazilian goods is expected to continue reshaping trade flows and supply chain strategies through the remainder of 2025. Wood and tile exporters are likely to continue encountering pressure, while coffee exporters are expected to further refine their routing operations.

Vessels remain available for bookings on most routes, creating opportunities for flexible shippers to secure competitive space allocations.

Brazil exporters will need to evaluate total landed cost scenarios between direct and triangular routing options as market conditions evolve.

South America-Europe

European trade lanes may demonstrate greater schedule reliability compared to other regions, with major carriers expected to maintain consistent service levels through Q4 2025. Improved schedule performance will support increasingly predictable transit times for Europe-bound cargo.

Mediterranean Shipping Company (MSC), CMA CGM, and Ocean Network Express (ONE) will continue using Southampton and Felixstowe for discharge operations, avoiding London gateway congestion. This routing strategy will maintain schedule integrity while managing port-related delays.

European demand patterns are expected to remain stable, supporting rate consistency and space availability. Coffee exporters will benefit from reduced complexity compared to U.S.-bound shipments.

Oceania

Export demand drives capacity constraints through Q4

Australian and New Zealand ocean freight markets continue demonstrating strong export performance during what is typically an off-peak period. East Coast Australia is experiencing robust volumes that signal sustained demand, creating tighter capacity conditions than seasonal patterns would normally suggest.

Cotton exports are driving strong demand and will keep vessel capacity constrained until grain season begins, typically in November. High cotton shipment volumes are filling available space and supporting rate levels across multiple trade lanes. Pulse exports—lentils, chickpeas, beans, and peas—from New South Wales and Queensland will consume significant vessel space through Q4 2025, adding to capacity constraints.

Overall rates remain steady across most Oceania export lanes, providing pricing predictability for regular shippers through September and October. However, specific trade lanes show divergent trends based on commodity type and destination demand.

Oceania-Asia

Southeast Asia and Indian subcontinent lanes show upward rate trends as vessels sail at consistently full capacity. Shippers should expect rate increases because of strong export demand combined with limited capacity growth.

Northeast Asia presents mixed conditions. Refrigerated container allocations from Australia's East Coast remain restricted, creating supply constraints that will push refrigerated cargo rates higher through September. Shippers of temperature-sensitive goods should secure refrigerated space three to four weeks in advance and budget for premium pricing.

Australia's West Coast refrigerated rates will decrease in Q4 2025 as seasonal demand patterns shift, offering potential cost savings for flexible shippers who can adjust timing or routing.

While volumes to China are increasing, rates to major Chinese ports remain under pressure as carriers compete aggressively for market share.

Oceania-U.S.

Space to U.S. East Coast (USEC) destinations should become more available from mid-September as traditional peak season demand slows. However, overall U.S.-bound capacity remains tight with rates holding firm despite seasonal easing, meaning significant rate reductions are unlikely even with improved space availability.

Download slides

Download slides